Competitor intelligence gives you an edge

Our model reacts quickly to market shifts with data-backed insights so you are ahead of the curve.

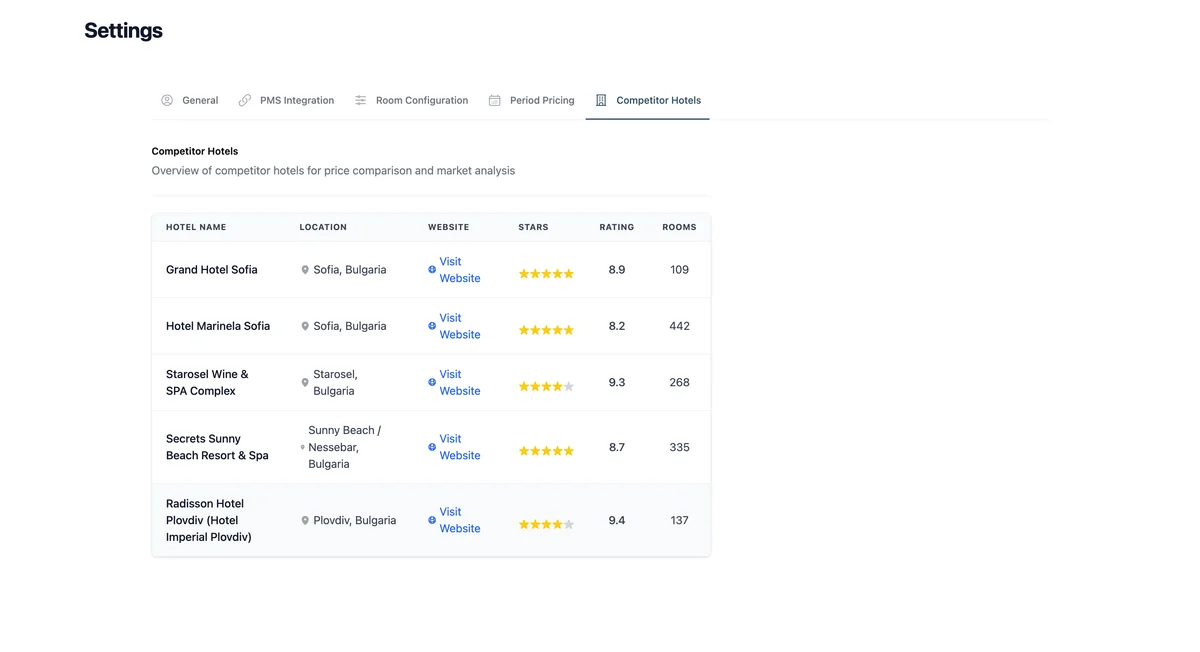

- Custom tracking

- Choose and adjust which competitors to track so the data stays relevant to your market and positioning.

- Direct impact

- Competitor data feeds directly into your rate recommendations, ensuring your pricing adapts to market shifts.

- Market positioning

- Understand your market position and identify opportunities to capture market share.

- System reliability

- By tracking competitor data, our model ensures you don't miss revenue opportunities even when other signals are quiet.

How Sigma Revenue Works

Synchronise

Integrate with your existing PMS, channel manager, and distribution channels in minutes.

Analyse

Our software analyses historical, real-time, and competitor data.

Optimise

Get actionable rate recommendations for a whole year in advance to maximise your revenue potential.

Related Terms

ARIAverage Rate Index

A competitive benchmarking metric that compares your hotel's ADR to the average ADR of your competitive set. An ARI above 100 means you're achieving higher rates than competitors; below 100 indicates you're pricing below market. Use ARI alongside MPI and RGI for a complete competitive picture.

Learn more →CompsetCompetitive Set

A carefully selected group of 4-6 competitor hotels that guests would realistically consider as alternatives to your property. Selection criteria include similar location, star rating, room count, amenities, and target market. Your compset forms the basis for all competitive benchmarking (MPI, ARI, RGI) and rate shopping activities.

Learn more →MPIMarket Penetration Index

A competitive metric comparing your hotel's occupancy to your compset's average occupancy. MPI above 100 means you're capturing more than your fair share of demand; below 100 indicates competitors are winning more bookings. MPI reveals whether your distribution, visibility, or value proposition needs attention—even if absolute occupancy looks healthy.

Learn more →Rate ShoppingRate Shopping / Competitive Rate Intelligence

The systematic monitoring of competitor rates across booking channels to inform your pricing decisions. Modern rate shopping tools automatically track compset prices daily, alerting you to competitive changes and identifying opportunities to adjust your positioning. Effective rate shopping reveals not just current prices but also availability, restrictions, and booking conditions.

Learn more →RGIRevenue Generation Index

The ultimate competitive benchmark, comparing your RevPAR to your compset's average RevPAR. RGI combines the effects of both occupancy (MPI) and rate (ARI) into one number. An RGI of 105 means you're generating 5% more revenue per available room than competitors. RGI above 100 indicates you're winning the market; below 100 means competitors are outperforming you.

Learn more →Ready to get started with Sigma Revenue?

Let's discuss how Sigma Revenue can help you optimise your hotel's revenue management.